Real Estate Done Differently.

We’re transformational. Not transactional.

Your Team

Working at your pace, Keleher + Co. brings 130 years of combined real estate experience to our partnership with you.

As a Scott McGillivray Trusted Agent, no one has more local experience or knowledge of South Georgian Bay than Chris Keleher and our team.

The Selling Experience

Get a unique selling plan and unwavering support with our collaborative approach to marketing and listing your property.

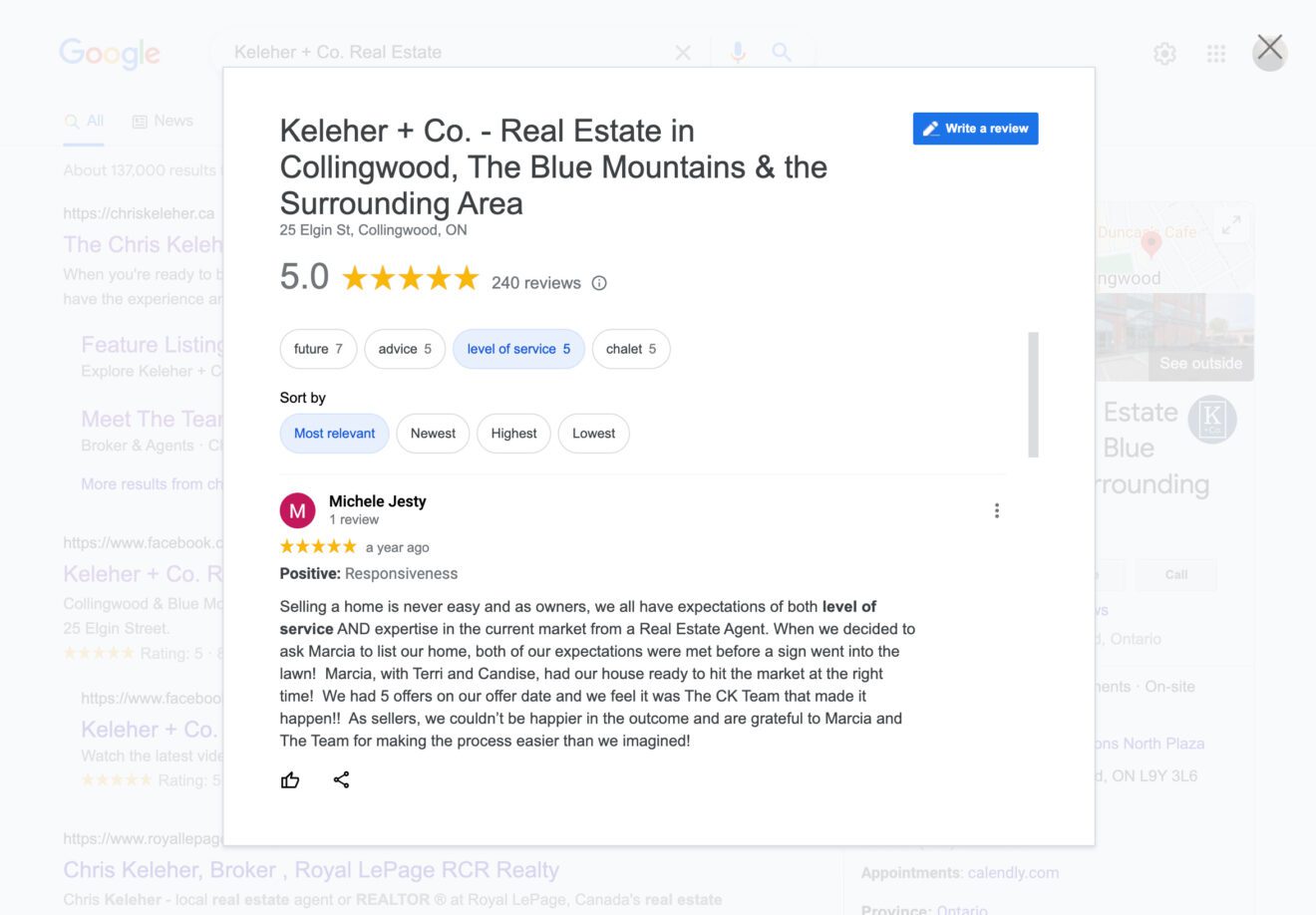

Five-Star Client Reviews

Our truest measure of success comes from our clients.

See hundreds of five-star Google Reviews here and read what your neighbours have to say about collaborating with Keleher + Co.

The Buying Experience

Get an education in local real estate and a strategic buying plan when you partner with us to find your forever home.

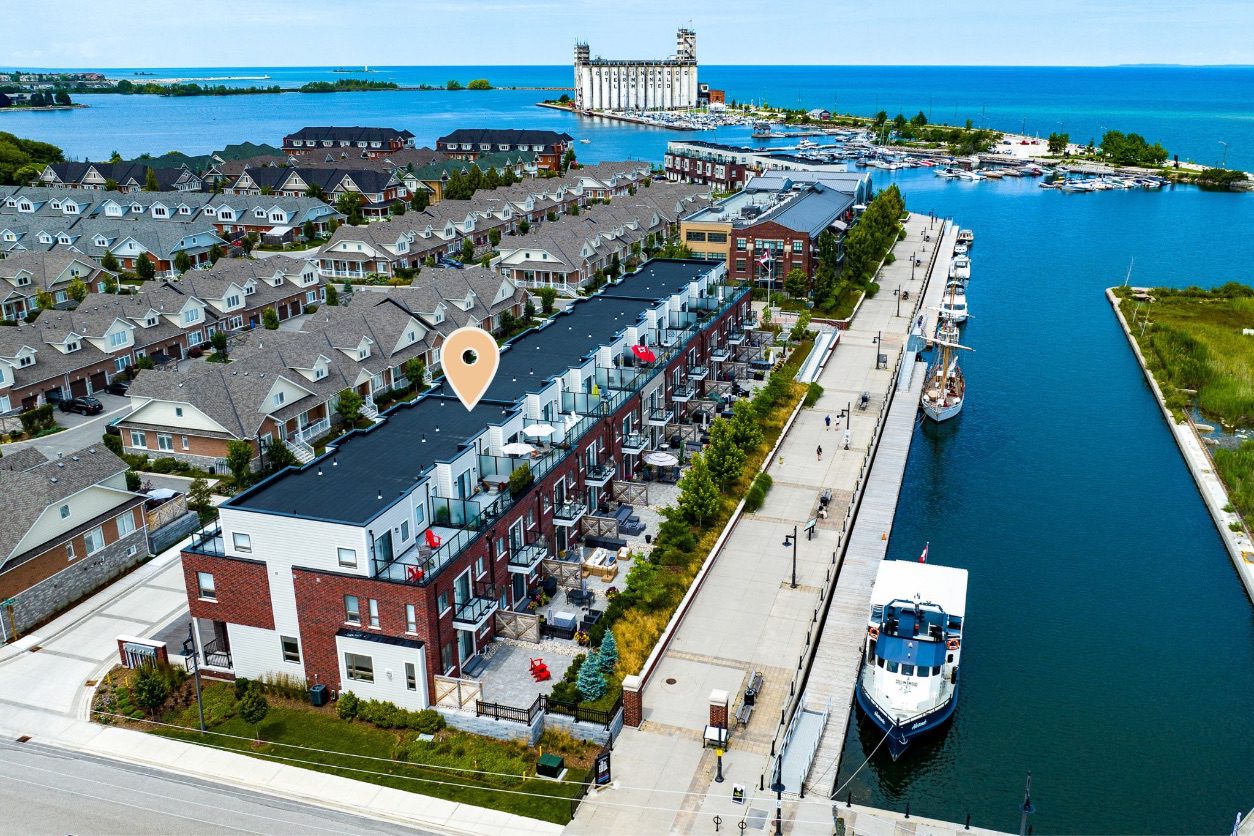

Our Listings

Browse the finest listings in Collingwood and South Georgian Bay.

Looking For Recent Neighbourhood Sold Prices?

Connect with our team to get the latest sold data by clicking the button below. Or view our recently sold portfolio for the latest properties that have we sold across South Georgian Bay here.

South Georgian Bay Realty Blog

After serving the Collingwood and surrounding area for decades, we’ve learned all there is to know about real estate in our communities — and we’re sharing it with you. Read our blog for updates on community news, “market” trends, and industry advice.